north dakota sales tax rate 2021

The County sales tax rate is. The Portland sales tax rate is.

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch Social Security Benefits Social Security State Tax

The governing body of any city or county may by ordinance impose a city or county tax.

. Lowest sales tax 45 Highest. 31 rows The state sales tax rate in North Dakota is 5000. 15 lower than the maximum sales tax in ND.

The Carson North Dakota sales tax rate of 5 applies in the zip code 58529. Did South Dakota v. Many cities and counties impose taxes on lodging and prepared foods and beverages.

The minimum combined 2022 sales tax rate for Northwood North Dakota is. The North Dakota sales tax rate is currently. There is no applicable county tax or special tax.

This is the total of state county and city sales tax rates. Pursuant to Ordinance 6417 as adopted June 23 2020 the boundaries of the City of Bismarck will change for sales and use. What is the sales tax rate in Northwood North Dakota.

For tax rates in other cities see North Dakota sales taxes by city and county. Local Taxes City or County Taxes Cities and counties may. If youre married filing taxes jointly theres a tax rate of 11 from 0 to 67050.

You can print a 65 sales tax table here. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible. The North Dakota sales tax rate is currently.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. The 65 sales tax rate in Wishek consists of 5 North Dakota state sales tax and 15 Wishek tax. An additional tax may be imposed on the rental of lodging and sales of prepared food and beverages.

Raised from 7 to 75 Hillsboro. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. The Manvel sales tax rate is.

There are approximately 521 people living in the Carson area. North Dakota State Sales Tax Rates. For those earning more than.

Please use the search option for faster searching. The North Dakota Department of Revenue is responsible. This is the total of state county and city sales tax rates.

374 rows 2022 List of North Dakota Local Sales Tax Rates. Over the past year there have been eighteen local sales tax rate changes in North Dakota. Detailed North Dakota state income tax rates and brackets are available on this page.

City of Bismarck North Dakota. What is the sales tax rate in Portland North Dakota. Local Taxing Jurisdiction Boundary Changes 2021.

The minimum combined 2022 sales tax rate for Grand Forks North Dakota is. You can lookup North Dakota city and county. The Northwood sales tax rate is.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. The County sales tax rate is.

North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Exact tax amount may vary for different items. The minimum combined 2022 sales tax rate for Portland North Dakota is.

The maximum local tax rate allowed by North Dakota law is 3. What is the sales tax rate in Manvel North Dakota. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck will change for sales and use tax purposes effective January 1 2021.

Did South Dakota v. The North Dakota sales tax rate is currently. The North Dakota State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Dakota State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Download our North Dakota sales tax database. Local Lodging Tax - May not exceed 2. The minimum combined 2022 sales tax rate for Manvel North Dakota is.

The North Dakota sales tax rate is currently. The County sales tax rate is. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0959 for a total of 5959 when combined with the state sales tax.

The County sales tax rate is. Did South Dakota v. New farm machinery used exclusively for agriculture production at 3.

We have tried to include all the cities that come under North Dakota sales tax. Groceries are exempt from the North Dakota sales tax. This is the total of state county and city sales tax rates.

North Dakota Sales Tax Rates 2021. Did South Dakota v. Free sales tax calculator tool to estimate total amounts.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. The minimum combined 2022 sales tax rate for Fargo North Dakota is. The North Dakota income tax has five tax brackets with a maximum marginal income tax of 290 as of 2022.

City Total Sales Tax Rate. Find your North Dakota combined state and local tax rate. Lodging Restaurant Tax.

With local taxes the. New mobile homes at 3. North Dakota sales tax is comprised of 2 parts.

Raised from 7 to 8 Hankinson. Did South Dakota v. This is the total of state county and city sales tax rates.

In North Dakota theres a tax rate of 11 on the first 0 to 40125 of income for single or married filing taxes separately. The Fargo sales tax rate is. Gross receipts tax is applied to sales of.

The County sales tax rate is. 2022 North Dakota state sales tax. Thats why we came up with this.

This is the total of state county and city sales tax rates. The North Dakota sales tax rate is currently. The Grand Forks sales tax rate is.

Remember that zip code boundaries dont always match. An alternative sales tax rate of 6 applies in the tax region Carson which appertains to zip code 58529.

Image Result For U S National Map Of Property Taxes Property Tax American History Timeline Usa Facts

.png)

States Sales Taxes On Software Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

The Most And Least Tax Friendly Us States

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Navigating Freelance Taxes In 2020 Managing Finances Filing Taxes Tax

North Dakota Sales Tax Rates By City County 2022

How Is Tax Liability Calculated Common Tax Questions Answered

The Corporate Tax Component Of Our Index Measures Each State S Principal Tax On Business Activities Most States Levy A Corporat Business Tax Income Tax Income

States Without Sales Tax Article

States With Highest And Lowest Sales Tax Rates

Corporate Tax Rates By State Where To Start A Business

District Of Columbia Sales Tax Small Business Guide Truic

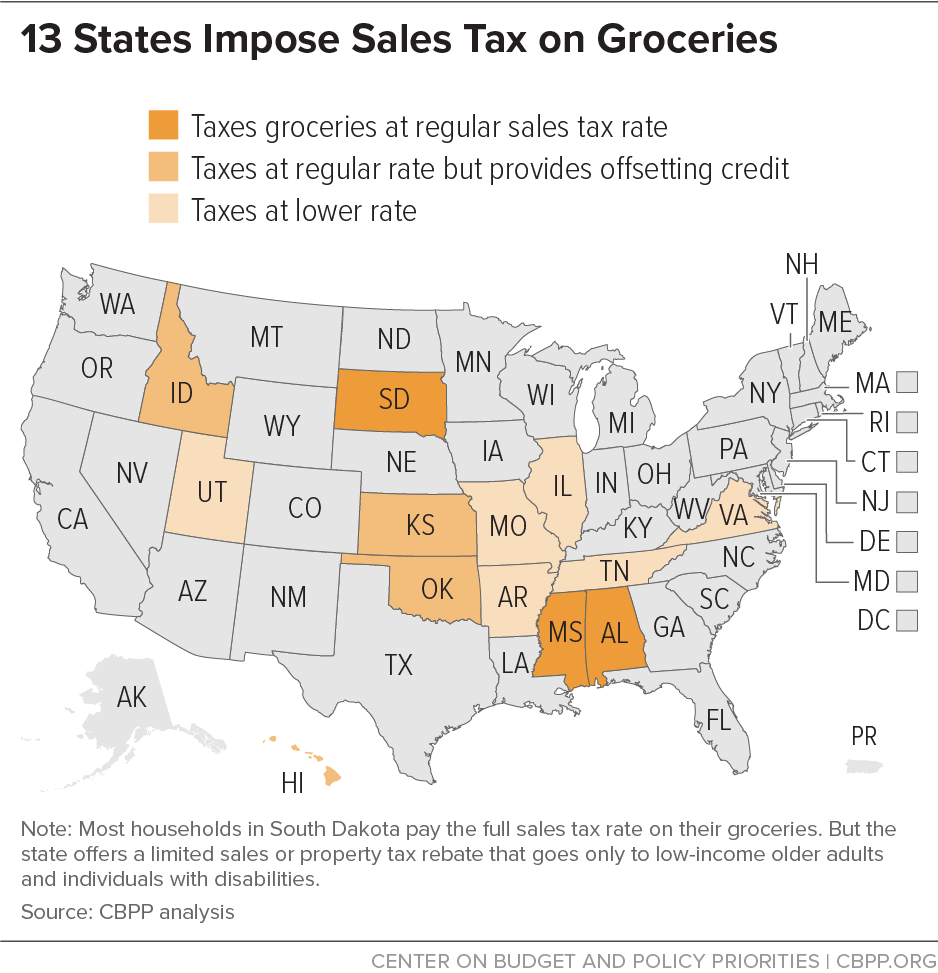

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Sales Tax By State Is Saas Taxable Taxjar

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times