south dakota property tax rate

Then the property is equalized to 85 for property tax purposes. Then the property is equalized to 85 for property tax purposes.

Port There S A Way We Could Have Property Tax And Income Tax Cuts

All property is to be assessed at full and true value.

. The South Dakota sales tax and use tax rates are 45. You can look up your recent. This data is based on a 5-year study of median property tax.

South Dakota Property Tax Rates. Lincoln County has the highest property tax rate in the state at 136. Across South Dakota the average effective property tax rate is 122.

This portal provides an overview of the property tax system in South Dakota. Find information tax applications licensing instructions and municipal tax rates for the Sturgis Motorcycle Rally. The tax rate is expressed in dollars per thousand and is calculated by dividing all taxable property values within a taxing jurisdiction by the budget required.

Highest Property Tax No Tax Data Pennington County South Dakota Property Tax Go To Different County 199500 Avg. If the county is at 100 of full and true value then the equalization. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective property tax rate of 128.

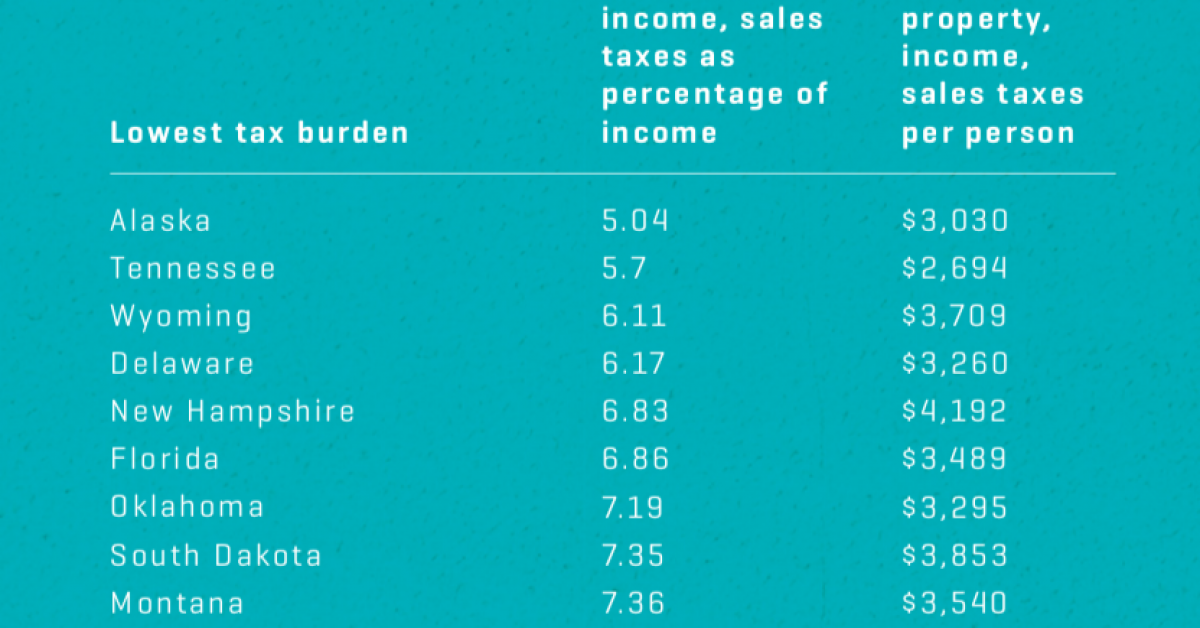

The median property tax in Gregory County South Dakota is 791 per year for a home worth the median value of 56100. South Dakota also does not have a corporate income tax. South Dakota Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent focused on your property bill.

This surpasses both the national average of 107 and the average in North Dakota which is 099. The portal offers a tool that explains how local property. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and.

What Rates may Municipalities Impose. 133 of home value Yearly median tax in Pennington County The median property tax in Pennington County South Dakota is 1995 per year for a home worth the median value of 149700. The effective average property tax rate in South Dakota is 122 higher than the national average of 107.

To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. 1-800-829-9188 option 2 Property Tax Division Email.

If the taxable value in a. Minnehaha County collects on average 142 of a propertys. The median property tax in Minnehaha County South Dakota is 2062 per year for a home worth the median value of 144900.

Information for South Dakota County Treasurers to explain. Gregory County collects on average 141 of a propertys assessed. Contents1 Is South Dakota a tax friendly.

State Summary Tax Assessors South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Welcome to the South Dakota Property Tax Portal. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would.

The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities. The state of South Dakota has a relatively simple property tax systemAcross the state the average effective property tax rate is 122. If you have any questions please contact the South Dakota Department of Revenue.

10 Best States For Lowest Taxes Moneygeek Com

2022 Property Taxes By State Report Propertyshark

Historical South Dakota Tax Policy Information Ballotpedia

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

How Are Property Taxes Calculated Plains Commerce Bank

Webster Area Development Corporation Financing Incentives

Property Taxes By State In 2022 A Complete Rundown

Are There Any States With No Property Tax In 2022 Free Investor Guide

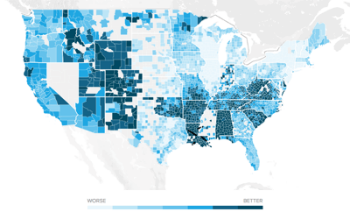

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Property Tax Calculator Smartasset

Tax Rates To Celebrate Gulfshore Business

North Dakota Officials Propose Flat Income Tax Rate Eliminating Individual Income Taxes For Most Taxpayers Inforum Fargo Moorhead And West Fargo News Weather And Sports

Property Taxes How Much Are They In Different States Across The Us

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

South Dakota Taxes Business Costs South Dakota

Shocking Low Property Taxes In South Dakota Are In This County